Summary

Elon Musk recently lashed out at news accounts critical of Nevada’s subsidy deal with Tesla. He insisted the deal is a “no-lose” for Nevada.

Was he talking about my articles? If so, I’m unrepentant, because he is wrong. I’ll detail his misstatements and explain why I believe Nevada taxpayers got a risky deal.

Many of the subsidies are far from “no-lose.” If Tesla fails to meet Nevada’s extravagant forecasts (and it’s already way behind), then Nevada taxpayers lose big.

Musk also said Tesla earns subsidies only if it generates $100 billion in Gigafactory output. That’s just wrong. There is no such output requirement.

A word about SolarCity. Although it has disappeared from Nevada, its subsidies go on and on. On top of Tesla’s subsidies, that’s another $1.3 billion. Thank you, Silver State taxpayers!

I. Introduction

On the May 4 earnings call, Elon Musk made a lengthy speech objecting to “all these sort of irritating articles like Tesla (NASDAQ:TSLA) survives because of government subsidies and tax credits.”

Here, I compare the claims made by Musk with the provisions of the October 17, 2014, Incentive Agreement between Tesla and the State of Nevada. I conclude Musk is simply wrong on several counts.

Before examining Musk’s claims, allow me to offer a few kind words for Nevada legislators and then review where things stand with the Nevada subsidies according to the latest official reporting.

A. Dear Nevada legislators, you did a much better job than your New York counterparts.

It’s no secret I’m critical of Nevada’s Incentive Agreement with Tesla. I believe that by front-loading the incentives, Nevada runs a significant risk of getting less than it bargained for.

However, as my recent review of New York’s “Buffalo Billion” Riverbend Agreement has forcefully driven home, Nevada state officials deserve a great deal of credit for three significant Incentive Agreement achievements:

- First, the language of the Nevada agreement is admirably clear. The agreement is elegantly drafted and is easy to understand, which will minimize any controversies if ever Nevada needs to seek a court’s help in enforcing it.

- Second, the deal is the deal. The Incentive Agreement and Tesla’s obligations under it remain unchanged since it was signed two and a half years ago.

- Third, the Nevada legislation requires periodic audits to be made and published. Those audits disclose the employees hired, capital expenditures made and transferable tax credits earned (though reporting about the electricity subsidies and tax abatements is a bit more obscure).

As I intend to detail soon, all three of these features compare very favorably with the Riverbend Agreement.

B. Where Things Stood in Nevada as of 9/30/16

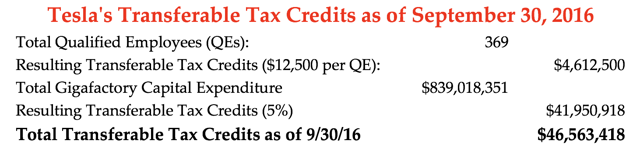

In Nevada, Tesla receives the tax credits for all “Qualified Employees” (employees working inside the Gigafactory a minimum of 30 hours per week). It also receives tax credits for capital expenditures made by it and any of its “Participants” (so far, only Panasonic).

The most recent official Nevada audit of Gigafactory progress was published last March and covered the third quarter of 2016. As of September 30, 2016, here are the results:

How do the employment and capital expenditure results compare with the earlier forecasts?

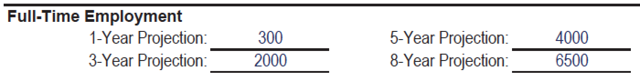

In the Incentive Agreement, Tesla projected Gigafactory employment only at 1, 3, 5, 8 and 10 years. The 1-year projection (October 2015) is 300 and the 3-year projection (October 2017) is 2,000.

If we interpolate for a 2-year projection, the number would be 1,150 by October 2016. Obviously, with only 369 QEs at the end of September 2016, Tesla didn’t come close.

Will the company achieve 2,000 QEs by this October? It’s possible, though it seems doubtful.

Rather than forecasting the timing of capital expenditures, Tesla projected completion dates for the 5 phases of the Gigafactory. It forecast that by the end of last September, Phases 1, 2 and 3 would be built, Phase 4 would be nearing completion, and Phase 5 would be underway.

Tesla’s results fell far short of its forecast. At the end of last September, only Phase 1 was complete, and construction of Phase 2 had just begun.

II. Does Tesla Survive Because of Government Subsidies? I Report, You Decide.

Now to the main event: Musk’s May 4 diatribe objecting to “all these sort of irritating articles like Tesla survives because of government subsidies and tax credits.”

While I want to focus on the Nevada subsidies, I think it’s clear Tesla’s survival depends heavily on government subsidies of all types (including tax credits).

In 2016, for instance, the company’s $762 million GAAP loss would have been $977 million without its ZEV credits. That works out to $2,823 of ZEV credits per car. Without those ZEV credits, it would have lost $12,810 per car last year instead of only $9,987.

The ZEV credits are but the tip of the subsidy iceberg. Tesla also benefits from the $7,500 U.S. federal income tax credit to EV buyers ($900 million plus and counting, to date). It benefits from hundreds of millions more of such subsidies in foreign jurisdictions. On top of all that, Tesla has saved hundreds of millions more thanks to California tax abatements and from other types of incentives and subsidies. And the company benefits from a variety of other subsidies in other American states.

Anyone doubting Tesla’s dependence on subsidies should look at what happens when the subsidies disappear. Sales fall off the cliff. Denmark and the State of Georgia provide two excellent examples. Hong Kong is about to provide another.

Not for nothing did the company spend $450,000 over the past year and a half on federal government lobbying efforts. As that the disclosure records detail, SolarCity was an even more lavish lobbying spender.

My colleague, Economics Man, recently visited a cathedral in Portugal. It led him to ruminate that the concepts of incentives, present value and optionality are at work even in matters of religious faith. He concluded, “Economics is everywhere. And incentives matter.” They matter for religious believers balancing present delights against an eternal reward, and they surely matter to Tesla selling cars.

Now, on to Nevada.

III. Musk’s Straw Man Argument

Musk began his May 4 speech with this:

And for that sake – I hope somebody doesn’t mention those Nevada tax credits, which for the Gigafactory, it makes it sound like we got a $1.3 billion check from the State of Nevada. We did not…. But a lot of articles provided it in the past tense. Tesla received $1.3 billion.

While I doubt Musk had me in mind, I have never written an article suggesting Tesla has already received $1.3 billion from the State of Nevada. To the contrary, I have several times, in exquisite detail, laid out the various subsidies and what the company must do to earn them. The most recent example is here.

There may be news stories stating Nevada awarded $1.3 billion in an up-front lump sum, but I don’t recall ever reading one, and I seriously doubt any perceptive reader interested in the topic could be under that impression.

IV. Musk’s Argument about Tax Abatements Is Plausible but Problematic.

Next, Musk said this (emphasis added):

Those tax credits are made up – the vast majority is just sales and use tax abatement on equipment in the Gigafactory. Taxes that otherwise wouldn’t have been there because there was just a bunch of rocks there before. And you don’t get a lot of taxes from rocks. So that’s why it’s essentially a no-lose proposition for the state.

In this passage, he mixes transferable tax credits with tax abatements. That’s an unfortunate confusion, as there are important differences.

Before we discuss why tax credits are different from tax abatements, let’s concede that as to the abatements, Musk at least has a colorable argument.

If Tesla had never located its Gigafactory in Nevada, then there would be no sales or business activity on which to abate either Local Sales and Use Tax or Modified Business Tax. And with no Gigafactory or related equipment, there would be no property on which to abate the Personal and Real Property Taxes.

However, are there not thousands of Nevada businesses that can make the same argument that had they never come to Nevada, there would just be a bunch of rocks here? Yet, those other enterprises are not favored with tax abatements. Why is it good policy for a state to single out a single enterprise for special treatment?

Musk’s argument also ignores the trade-off that occurs if Gigafactory employment adds to the area’s population. Adding residents increases the government’s burden in providing schools, roads, water and sewer services, police protection, etc.

V. However, Tax Credits Are Quite Different from Tax Abatements

For all its weaknesses, Musk’s assertion that the tax abatements are “no-lose” for Nevada is at least halfway plausible. Rocks don’t generate any taxes.

The transferable tax credits, however, are a different story. They are a certain loss for Nevada taxpayers if the company fails to live up to its promises.

Tesla can earn a total of $195 million in transferable tax credits by hiring “Qualified Employees” and building and equipping the Gigafactory. Every dollar of transferable tax credits earned by the company is one less dollar of tax revenue Nevada would otherwise collect. Why? Because Tesla sells the tax credits to other Nevada taxpayers (such as MGM Grand Las Vegas Hotel and Casino), who apply it to the taxes they would otherwise owe the state.

That’s not to say the company receives 100 cents on the dollar in selling a tax credit. It doesn’t. The tax credits are sold at a slight discount, depending upon how many other taxpayers bid for the credits and Tesla’s need for quick cash.

However, even though Tesla receives less than 100 cents on the dollar for the credits, the State of Nevada loses all 100 cents. To see why, let’s take the $20 million MGM Grand transaction as an example.

Let’s assume MGM Grand paid Tesla 90 cents on the dollar. Here’s how everyone made out:

- Tesla received $18 million that MGM Grand would otherwise have paid to the State of Nevada.

- MGM Grand saved $2 million by buying the tax credits from Tesla.

- Nevada lost $20 million of tax revenue otherwise payable by MGM Grand.

Who makes up the $20 million difference? Other taxpayers in Nevada, of course.

So no, Mr. Musk, the $195 million of transferable tax credits are not a “no-lose” proposition for Nevada. Rather, they are a 100% loss of $195 million in tax revenues, plus an indirect subsidy to industries (such as MGM Grand and other purchasers of Tesla’s credits) which the legislature had no intention of benefiting.

VI. No, It’s Not “Just Sales and Just Tax Payment over 20 Years”

Musk also said this:

It’s (the subsidy package is) just sales and just tax payment over 20 years.

Except the subsidy package is not just tax abatements and tax credits. There are two other Nevada giveaways that were part of the overall Gigafactory subsidy package: discounted electrical rates and free land. (I’ll ignore the $70 million in highway construction, assuming it eventually would have happened anyway.)

The Incentive Agreement grants Tesla discounts for eight years on “up to 25 megawatts of power.” The discount is 30% for the first two years, 20% for the next four and 10% for the final two. Those discounts must be paid for by other Nevada ratepayers in the form of higher rates.

How much are the discounts worth? That would seem to depend on how many megawatt hours Tesla consumes. It appears commercial electricity costs in the Las Vegas, NV, area are 8.43 cents per kWh. I lack information about the Gigafactory’s electrical consumption, and so cannot make an educated estimate, but the dollar amount of savings over eight years is surely material.

Also, while it’s not part of the Incentive Agreement, the State of Nevada put the Gigafactory site into the company’s hands for free by paying $43 million to Lance Gilman (“a tenacious Storey County commissioner, a multimillionaire and real estate tycoon“) in a three-way land deal.

Those were 43 million real dollars spent by the state, which had to be furnished by other taxpayers.

VII. Musk’s claim about “$100 billion in output from the Gigafactory” is false.

Let’s now look at this claim by Musk during the conference call (emphasis added):

And in order for us to actually earn $1.3 billion in tax credits for the Gigafactory, we have to generate over the course of 20 years about $100 billion in output from the Gigafactory.

This claim echoes a claim by Tesla that we see in various news accounts. For instance:

“Tesla only receives these incentives if it performs,” according to the company’s statement. “They are tied to Tesla generating an estimated $100 billion of positive economic impact for Nevada and spending a minimum of $3.5 billion.”

The claim is false. There is absolutely no requirement in the Incentive Agreement or anywhere else that Tesla generate $100 billion of “positive economic impact” to enjoy the Nevada subsidies.

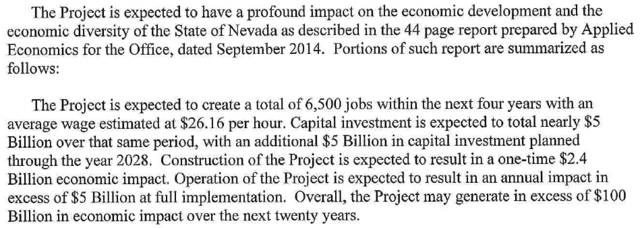

The company surely knows the claim is false and, if Musk is the genius so many commenters here are always telling me he is, he knows it, too. The “$100 billion of positive economic impact for Nevada” comes from the 2015 report of Applied Economics, a consultant Nevada hired to estimate the benefits Tesla could bring to the state.

Even the Applied Economics report did not speak in terms of $100 billion of “output from the Gigafactory.” Rather, the $100 billion figure was the consultant’s estimate of the “construction impacts” from building the entire Gigafactory in three years (October ’14 to October ’17), combined with the “operations impact” of having not only 6,500 Gigafactory employees, but also another 16,200 of resulting “indirect” employment in Storey and Washoe Counties, all over a 20-year period.

Tesla’s own Nevada lawyers are perfectly aware of this. They wrote as much in a letter attached to the Incentive Agreement:

Already, the assumptions underlying that $100 billion number have proven far too rosy. Applied Economics assumed, as Tesla originally promised, that the company would build all five Gigafactory phases by this October. That won’t happen. Tesla will have completed only two and not even started work on the following three.

When it comes to economists’ reports that pretend to project future growth and revenues, every mistaken assumption has a cascading effect. Less construction means fewer construction workers. Fewer construction workers means less construction wages. Less construction wages means far less other spending (and tax revenue) in Storey and Washoe Counties.

The same negative cascade is even more significant for the permanent employment forecasts. While the Gigafactory will surely employ more than 369 people by October, it just as surely will employ far fewer than the 2,000 forecast by Tesla.

If, for instance, there are only 800 Gigafactory employees by October, that’s 1,200 fewer new jobs in Nevada this year. That translates into 1,200 fewer households spending their Gigafactory income.

That’s correspondingly fewer “support” jobs in the region providing goods and services to those 1,200 households. Which also means correspondingly less property tax collected on the homes owned by those missing Gigafactory and support households, and correspondingly less sales tax because of the missing purchases they would otherwise make.

Anyone wanting to see the analysis (and to chart how far inaccurate the employment and capital expenditure forecasts already have proven to be) can turn to pages 5 and 6 here.

Will Musk and Tesla correct their mistaken claim that Tesla’s subsidies are “tied to” achieving “Gigafactory output” of $100 billion? TBD. But I’m not holding my breath.

VIII. Thought Experiment

Let’s conduct a thought experiment. Let’s say Tesla, Panasonic (OTCPK:PCRFY) and other “Participants” achieve an employment level of 6,000 employees by the end of 2019. And let’s assume they collectively spend $3.5 billion on capital expenditures by that time.

If all that happens, Tesla would have earned the entire $195 million of transferable tax credits. Assume further that, by that time, the company had enjoyed $300 million in tax abatements (that’s a wild guess but hardly a fanciful one, as shown here).

Now, it’s of course possible that by 2019 everything will have gone splendidly for Tesla. Demand for the Model 3 will have proven almost insatiable. Homeowners everywhere will be clamoring for Tesla solar roof tiles and Powerwalls. The company will have become profitable and will be continuing its dramatic growth curve. The economic forecasts on which the Incentive Agreement was premised will have been vindicated.

But let’s also acknowledge things could go poorly for the company. By 2019, it may be clear the Model 3 cannot generate profits. Competition arriving in 2018 and 2019 from Jaguar (NYSE:TTM), Audi (OTCPK:AUDVF), Daimler (OTCPK:DDAIF) and several others could have further eroded Tesla’s margins on all its cars. The company’s battery storage business could have remained small and unprofitable.

Tesla would be bankrupt. The Nevada consultant’s projection of 22,700 employees for a 20-year period in Storey and Washoe Counties, with its related $100 billion in economic impact, would be a huge bust.

Nevada would have been a huge loser, to the tune of $43 million (factory site) plus $195 million (tax credits) plus $300 million (tax abatements) plus some other amount of electrical subsidies. In other words, Nevada taxpayers would be out more than half a billion dollars with not much to show in return except for some jarring economic dislocation.

That, my friends, is by no means a “no-lose” proposition.

Nevada’s only remedy would be to sue Tesla to recover the tax credits and tax abatements. But even then, the state would face two immense obstacles.

- First, if Panasonic remained in the Gigafactory with a shrunken employee base, conducting cell manufacturing separate from Tesla, Nevada would have to wait until June 30, 2024, to file such a suit. That’s a loophole in the language of the Incentive Agreement.

- Second, in bankruptcy proceedings, Nevada would be a mere unsecured creditor. It’s doubtful the state could recover much, if anything.

IX. Guess who else has a $1.3 billion subsidy package?

Guess who else has been a big piggy at the Nevada taxpayer trough? Why, SolarCity, to the tune of another $1.3 billion.

Subsidies are forever. Even though SolarCity eliminated 550 Nevada jobs after the Public Utilities Commission refused to continue net metering (in effect, a subsidy from those who don’t own solar panels to those who do), the subsidies for the company go on and on.

Do you want a preview of how the state’s rosy forecasts about Tesla might play out? Look at this fiscal year 2014 report on Nevada tax abatements awarded to SolarCity, along with the (then) anticipated benefits ($12 million in annual wages).

X. Conclusion

It’s understandable why local governments are eager to attract jobs and are willing to risk taxpayer money to do it. But the subsidy packages are risky, and they frequently don’t work out well.

There are ways to structure subsidy deals so that the taxpayers don’t sacrifice too much if the subsidized business fails to generate the promised benefits. Tax abatements are, relatively speaking, an intelligent idea. So, too, are tax credits that, instead of being transferable, can be used only by the subsidized company to offset future state taxes.

However, giving things away up-front – such as land, electricity and transferable tax credits – is far riskier. If the rosy economic projections never come to pass (as they so frequently don’t), then the taxpayers will be burned.

And regardless of the wisdom or folly of the Nevada subsidy package, Mr. Musk and his company should stop making misleading claims about the Nevada Incentive Agreement.

XI. A Final Word

I’ve said this a lot for the past several months, but I don’t think I can say it enough: TSLA is not an investment. It is a gamble. A speculation. A religion, perhaps. But it is not an investment.

I am deeply skeptical about the company’s prospects. I think its fundamentals are dreadful. It will certainly lose money this year and in 2018. Analyst forecasts notwithstanding, I’m confident the company will lose money in 2019 as well.

And, there will be more capital raises (and consequent dilution) ahead. Musk’s talk of a new factory for the Model Y (Bertel Schmitt has a brilliant take on that) is nothing if not a foreshadowing of another capital raise, likely later this year.

However, right now, the share price and fundamentals live in two separate universes. To many, Elon Musk is a combination of Thomas Edison, Al Gore, Thomas Paine and Jesus Christ. You can disagree with that view all you care to, but as an investor, you should not ignore how pervasive it is.

TSLA stock is on fire. There is no way to know when that will change or what the catalyst will be. You may think it’s tempting to short this stock at these stratospheric prices. My advice is: Don’t do it. Leave that to guys like Jim Chanos who can afford to lose their entire Tesla short stake.

Just sit back and enjoy the show. Some day, things will again be sane. Then we can discuss whether and how to short TSLA.